Condo Insurance in and around Omaha

Townhome owners of Omaha, State Farm has you covered.

Cover your home, wisely

Your Belongings Need Insurance—and So Does Your Townhome.

Because your unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to smoke or weight of snow. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Townhome owners of Omaha, State Farm has you covered.

Cover your home, wisely

Put Those Worries To Rest

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance protects more than your condo's structure. It protects both your condo and the things inside it. In case of vandalism or a burglary, you may have damage to some of your belongings on top of damage to the townhouse itself. Without insurance to cover your possessions, the cost of replacing your items could fall on you. Some of your belongings can be insured against damage or theft even when they are outside of your condo. If your bicycle is stolen from work, a condo insurance policy may cover its replacement.

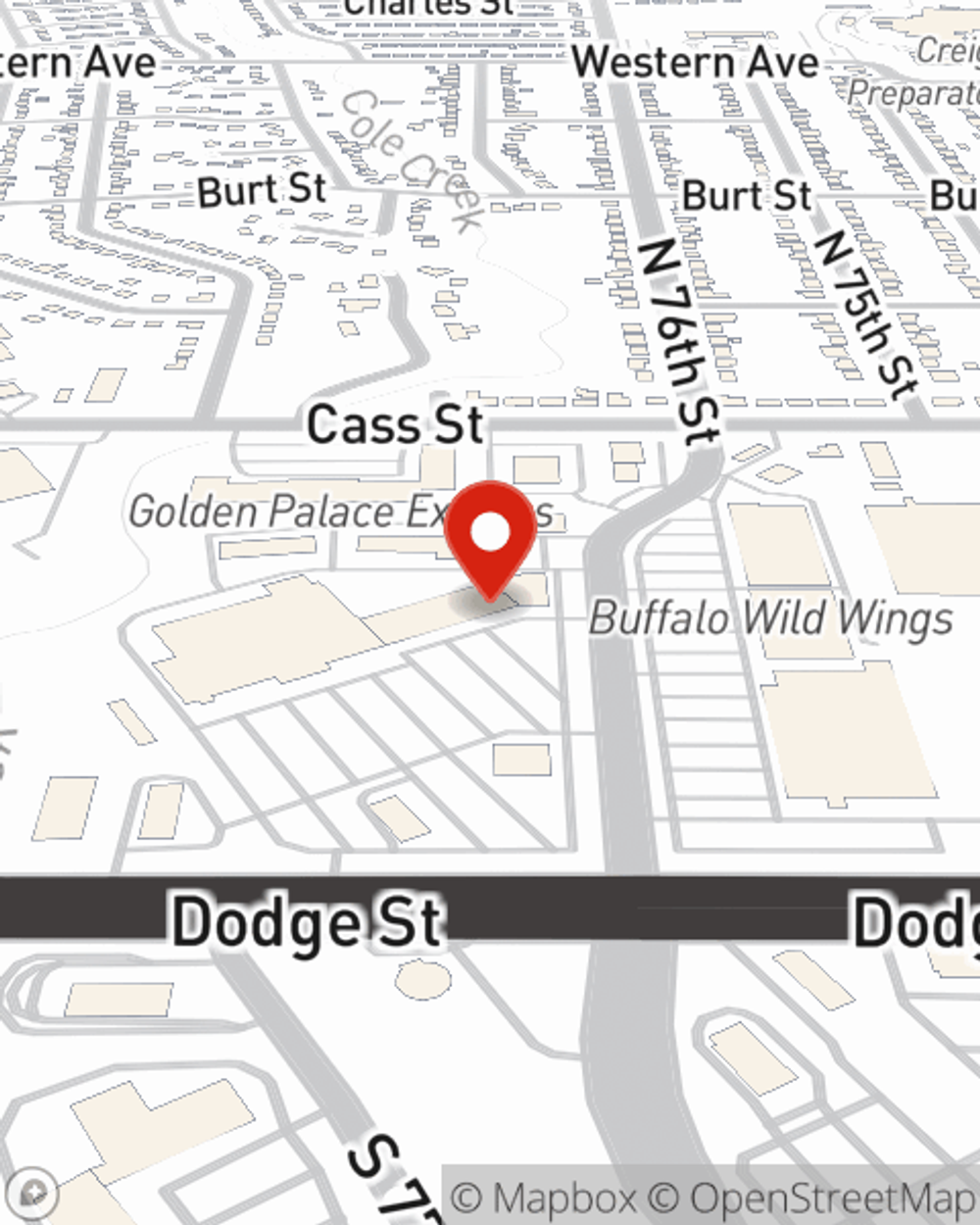

If you want to find out more information, State Farm agent Linda Miller is ready to help! Simply call or email Linda Miller today and say you are interested in this fantastic coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Linda at (402) 391-2673 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Linda Miller

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.